change in net working capital formula

Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000.

Fcf Formula Formula For Free Cash Flow Examples And Guide Free Cash Cash Flow Cash

Net working capital ratio is found by dividing current assets by current liabilities.

. The net working capital formula is calculated by subtracting the current liabilities from the current assets. Now Changes in Net Working Capital 12500 9500 3000. Here you can see the value comes out to be negative.

An increase in net working capital means cash outflow and vice versa. You can use the following formula for calculating NWC ratio. For the year 2019 the net working capital was 7000 15000 Less 8000.

Example calculation with the working capital formula. It comprises inventory cash. As per the above table the Net Working Capital of Jack and Co Pvt.

Change in Net Working Capital 4396000. You include change in cash as a part of change in overall working capital. Net working capital 106072 98279.

Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000. Total Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. Current Operating Assets 50mm AR 25mm Inventory 75mm.

Working capital is a measure of both a companys efficiency and its short-term financial health. 240000 2022 105000 2021 135000. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value.

For year 2020 the net working capital is 10000 20000 Less 10000. You must be logged in to post a comment. If the price per unit of the product is 1000 and the cost per unit in inventory is 600 then the companys working capital will increase by.

Net Working Capital Total Current Assets Total Current Liabilities. Net Working Capital NWC 75mm 60mm 15mm. The formula for working capital is current operating assets minus current operating liabilities.

Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. Change in a Net Working Capital Change in Current Assets Current Assets Current assets refer to those short-term assets which can be efficiently utilized for business operations sold for immediate cash or liquidated within a year. A companys net working capital can experience changes too which can affect cash flow.

However net working capital does not include the long-term fixed assets and long-term debt except the portion due within. If a company stock piles a ton of cash you can treat some of it as excess cash and tack it back on after youve completed the entire DCF valuation. To calculate our change in working capital we will take all the items from the assets and add them together.

Changes in Working Capital measures the difference in a companys Net Operating Working Capital between two periods of time. Change in Net Working Capital 6710000 2314000. Changes in net working capital impact cash flow in financial modeling.

Cash on hand varies for different companies but having. Heres a couple examples. 38500 29000.

Net Working Capital Formula. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm. Net Working Capital Current Assets Current Liabilities.

For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it. So the change in NWC is 135000. Total current liabilities Sundry Creditors Outstanding advertisements 45000 5000 50000.

It still counts as cash that is tied into running the day to day operations of the business. Then we will do the same for the liabilities. Now changes in net working capital are 3000 10000 Less 7000.

The business would have to find a way to fund that increase in its working capital asset perhaps by selling shares increasing profits selling assets or incurring new debt. Based on the above calculation the Net working capital of Colgate Palmolive India is positive which indicates that the short-term liquidity position of the company is positive. Typical current assets that are included in the net working capital calculation are cash accounts receivable.

Net working capital 7793 Cr. Changes in Working Capital measures the difference in a companys Net Operating Working Capital between two periods of time. Working capital is calculated as.

Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. ABC Company enjoys 310000 of equity 650000 of total assets minus 340000 of total liabilities. This indicates that the firm is out of funds.

What are changes to net working capital. Here is what the basic equation looks like. Changes in working capital are an idea that lives in the cash flow statement.

A company can increase its working capital by selling more of its products. Net Working Capital 6710000. Change in Net Working Capital is calculated using the formula given below.

Thats 150000 current assets minus 180000 current liabilities. Net Working Capital Formula Current Assets Current Liabilities. Be a star analyst.

Several more changes that can affect the net working capital include. The last step is to find the change in net working capital. This change in working capital is reflected in the cash flow statements to calculate cash flows from operations.

As for the rest of the forecast well be using the. Changes in working capital -2223. The Net Working Capital Formula is.

Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. Net Working Capital Ratio Current assets Current Liabilities. Net working capital for ABC Company equals 30000.

The Quick Ratio And Current Ratio. Below is an example balance sheet used to calculate working capital. Net working capital ratio.

Owner Earnings 8903 14577 5129 13312 2223 13084. For instance new projects business expansion and cash usage are changes in processes that can affect the net working capital. If your working capital ratio is below 1 it may indicate a company is in a.

The last step is to determine the change in working capital by using the formula. Thus the value of working capital in 2021 comes out to be -9972000000. In this case the change is positive or the current working capital is more than the last year.

In this example net working capital has increased by 3000.

Cash Flow From Operating Activities Learn Accounting Accounting Education Cash Flow

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Capital Structure Theory Net Operating Income Approach Theories Approach Financial Management

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Operating Budget Budgeting Financial Life Hacks Budget Meaning

Gross Vs Net Revenue Difference Importance And More Bookkeeping Business Money Management Learn Accounting

Fundamental Accounting Equation In 2022 Accounting Accounting And Finance Check And Balance

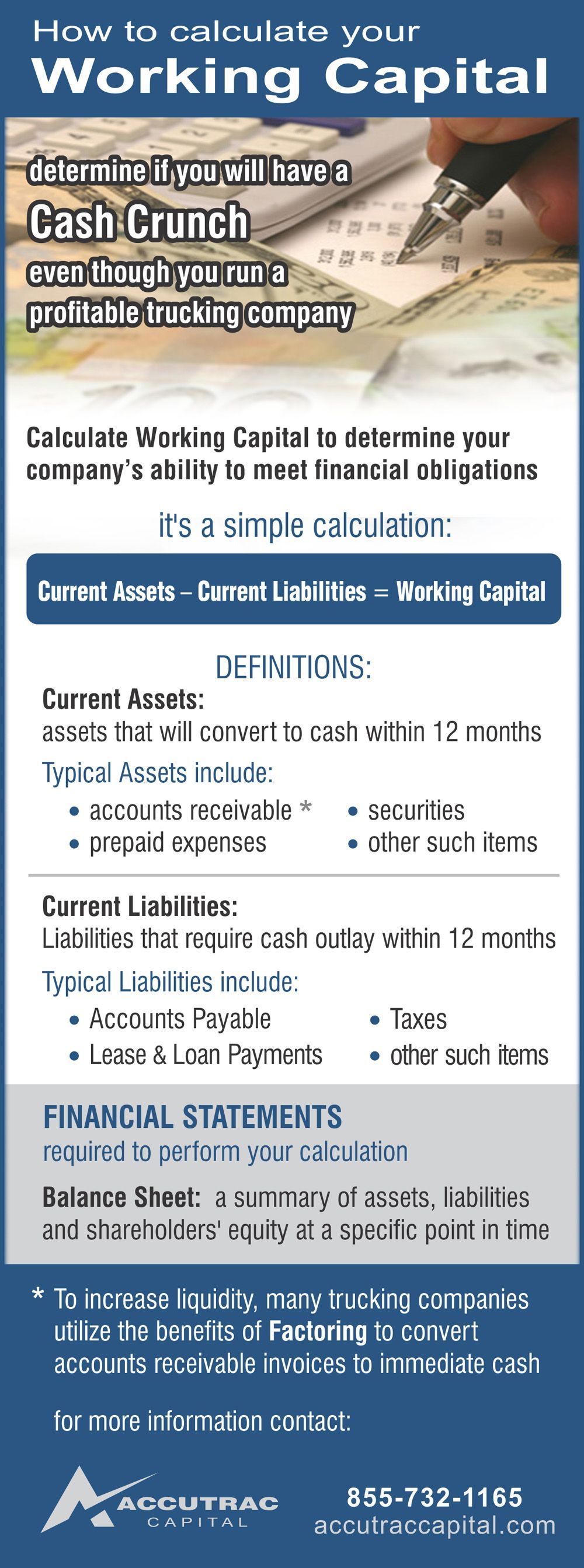

Have You Determined If You Have Enough Working Capital To Run A Profitable Trucking Comp Bookkeeping And Accounting Accounting And Finance Financial Management

Factors Determining Working Capital Requirement In 2022 Accounting And Finance Factors Personal Finance

Difference Between Hire Purchase Vs Installment Purchase System Hire Purchase Accounting And Finance Learn Accounting

Types Of Financial Statements Bookkeeping Business Learn Accounting Accounting Basics

Discouraged Workers Find A Job Looking For A Job Discouraged

Maturity Matching Or Hedging Approach To Working Capital Financing In 2022 Capital Finance Accounting Education Financial Instrument

Infographic What Is A Working Capital Loan Infographicbee Com Finance Loans Educational Infographic Infographic

Internal Growth Rate Meaning Importance And More Growth Financial Health Financial Management

Working Capital Turnover Ratio College Adventures Interpretation Ratio

Days Working Capital Dwc Economics Lessons Financial Analysis Business Management Degree

Free Cash Flow Cash Flow Cash Flow Statement Positive Cash Flow

Fundamental Accounting Equation In 2022 Accounting Accounting And Finance Check And Balance