tax deferred exchange definition

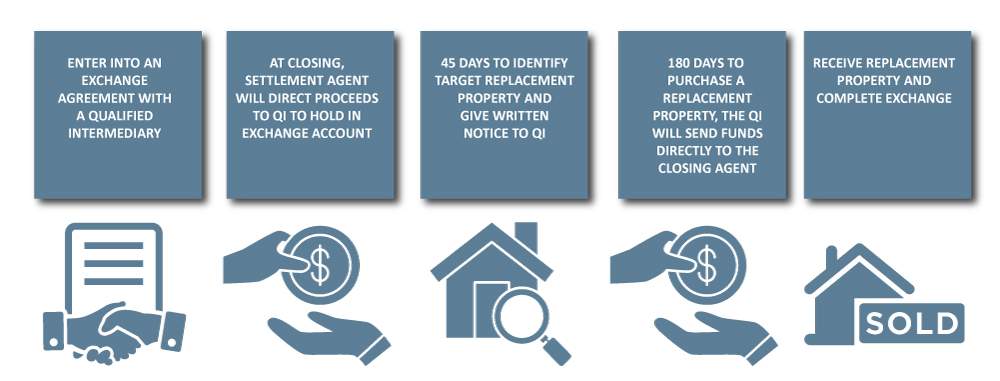

In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. 1031 Exchanges are complex tax planning and wealth building strategies.

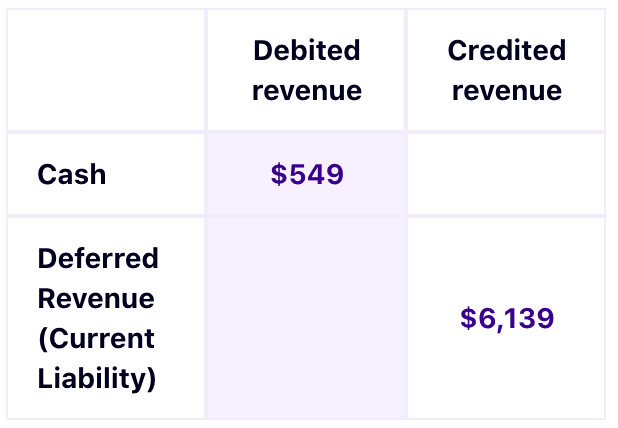

Deferred Revenue Definition How It Works Examples Chargebee Glossaries

A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

. The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. This is a procedure that allows the owner. Like-kind property When two properties belong to the same.

Not taxed until sometime in the future a tax-deferred savings plan. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while deferring the payment of federal income taxes and some state taxes on the transaction. Tax-deferred status refers to investment earningssuch as interest dividends or capital gainsthat accumulate tax-free until the investor takes constructive receipt of the profits.

What is Tax Deferred. Sometimes people say tax-free exchange but. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred.

In the investment world tax deferred refers to investments on which applicable taxes typically income taxes and capital gains taxes are paid at a future. By completing an exchange. Those taxes could run as high as 15.

1031 Exchange 1031 tax deferred exchange Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. A deferred or reverse exchange thereby disqualifying the transaction from Section 1031 deferral of gain. A tax-deferred exchange in which one asset is exchanged for a similar asset of the same nature character or class.

Learn what a deferred 1031 exchange is and why its important. The definition is vague. When selling real estate sellers can face significant tax obligations from the profit of the.

By Randy Kaston on March 29 2022. This post was co-authored with John Starling Senior Vice President Northern 1031 Exchange LLC. 1031 Tax Deferred Exchange Explained.

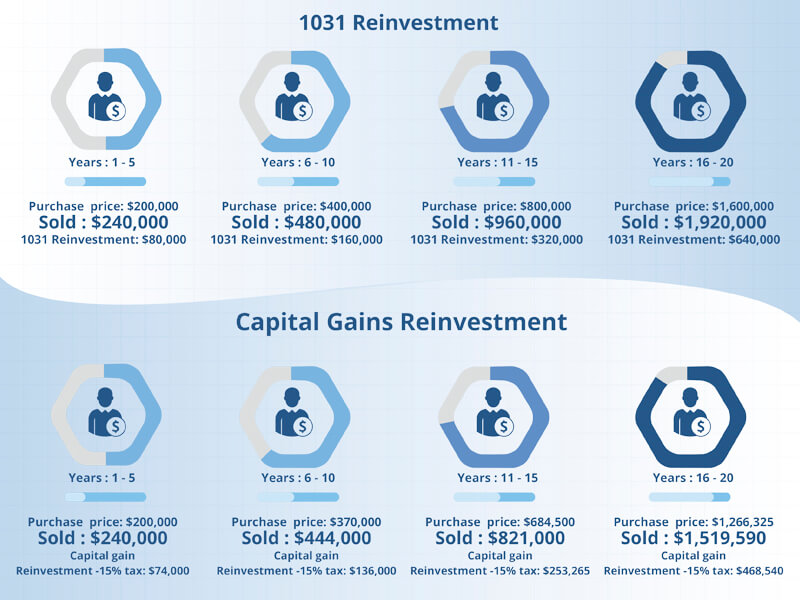

The gain may be taxable in the current year while any losses the taxpayer suffered. In summary a 1031 exchange is a way to defer the payment of these taxes- thats why it is referred to as a 1031 tax-deferred exchange. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset. A like-kind exchange is a tax-deferred transaction allowing for the disposal of an asset and the acquisition of another similar asset.

Under Section 1031 of the United States Internal Revenue Code 26 USC. 1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange. If you own investment property and are thinking about selling it and buying another property you should know about the 1031 tax-deferred exchange.

The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property. More What Is a Reverse Exchange. A deferred exchange may help you capture tax benefits offered by a 1031 exchange.

The termwhich gets its name from Internal. It may take time.

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

Are You Eligible For A 1031 Exchange

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

What Is A 1031 Exchange Dst How Does It Work And What Are The Rules

Image Result For Finance Management Accounting And Finance Project Finance Finance

1031 Exchange Explained What Is A 1031 Exchange

1031 Exchange How You Can Avoid Or Offset Capital Gains

What Is A 1031 Exchange Asset Preservation Inc

Tax Deferral How Do Tax Deferred Products Work

What Is The Benefit Of Tax Deferred Growth Great American Insurance

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

What Is A 1031 Exchange Properties Paradise Blog

6 Steps To Understanding 1031 Exchange Rules Stessa

What Is A 1031 Exchange Commercial Real Estate Md Va Dc

1031 Exchange When Selling A Business

6 Steps To Understanding 1031 Exchange Rules Stessa

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

What Is Tax Deferral What Does Tax Deferral Mean Tax Deferral Meaning Definition Explanation Youtube